EveryDollar Review: A Look at the Features of Dave Ramsey's Budgeting App

EveryDollar

Product Name: EveryDollar

Product Description: EveryDollar is a zero-based budgeting app built by Dave Ramsey and follows the Ramsey principals of financial management.

Summary

EveryDollar is Dave Ramsey’s budgeting app. It has a free version that you can use as long as you like, but eventually, you’ll likely want to sign up for the premium version so you can automatically download transactions from your bank accounts.

Pros

- Free version available

- Integrates well into the Dave Ramsey Baby Steps (with paid plan)

- Easy to set up and get started

Cons

- Must pay to link bank accounts and download transactions

- Unspent amounts don’t roll over to the next month.

EveryDollar is one of the most well-known budgeting apps since it was built by financial guru Dave Ramsey. It relies on his money principles, known as the Baby Steps, and the debt snowball repayment technique.

Dave Ramsey can be a polarizing figure but so many have used his approach to get out of debt. I’ve talked to people who used his books to get their financial life in order.

The results speak for themselves. You don’t have to agree with his personal and political views if you want to use his personal finance approach.

At a Glance

- The free version allows you to create a budget and manually add spending transactions.

- To connect your bank accounts and automatically import transactions, you’ll need to upgrade to the paid version.

- The premium version offers goal setting, paycheck planning, a financial roadmap, and access to a financial coach.

Who Should Use EveryDollar?

EveryDollar is perfect for Dave Ramsey fans. If you already have Ramsey+, which gives you access to his course Financial Peace University, EveryDollar is included in what you are already paying for, making it a no-brainer to at least try it out.

The Premium+ plan also allows you access to the financial roadmap, which will show you exactly when you’ll accomplish each Baby Step. This can be especially motivating for those following the Dave Ramsey system.

EveryDollar Alternatives

|

|||

| Cost | $109 per year | $2.99 per month for the first year | Free |

| Free trial | 34 days | 30 day money back guarantee | N/A |

| Unique feature | Proactive, not reactive | Easy to use | Strong investment tracking |

| Learn more | Learn more | Learn more |

Table of Contents

How Does It Work?

EveryDollar uses the budgeting system known as zero-based budgeting. In zero-based budgeting, you assigned every dollar to a category. It’s very similar to envelope budgeting.

This is where you input your monthly income and plan your entire month’s spending ahead of time. You set up budgeting categories and then allocate your income to those categories.

Then, you use the app to track your spending daily. If you have the free app, you manually enter your transactions. If you pay for EveryDollar Plus, you can link accounts, and it’ll automatically pull in transaction data.

Setting Up EveryDollar

Signing up is easy. After you register, you’re asked to pick one or more money goals:

Next, you’re asked for some more personalized information:

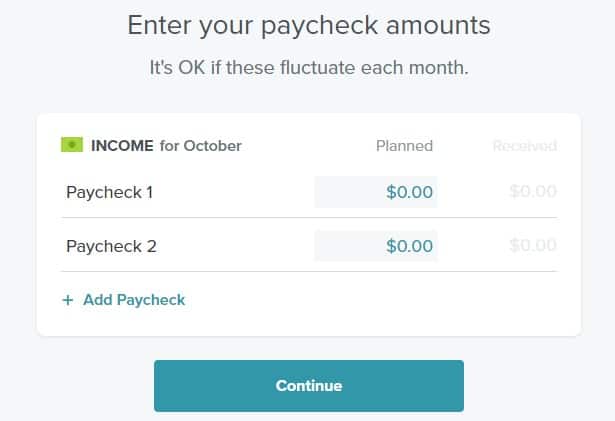

The setup process continues with you entering your income, expenses, giving, and debt figures.

Here’s what the income section looks like:

If you are paid every two weeks, you can set the income to be your total in a month or set two (or three depending on the month) line items for the two pay cycles.

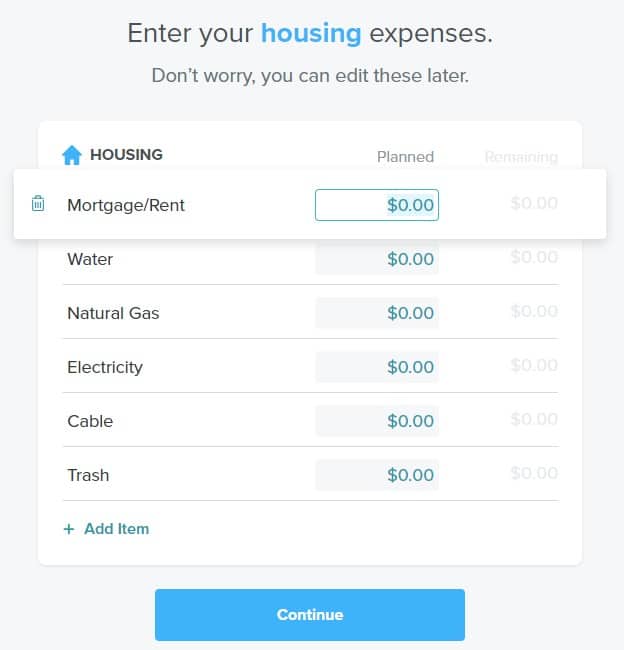

Then you’ll enter your basic expenses (housing, utilities, food, transportation and “personal expenses.”) It will walk you through each section, but don’t worry, they are all easy to change later.

You can edit the names of the line items and add new items to each list. Throughout the process, you can review how well you allocate your income.

Once you’ve added each of your budget line items, you’ll see your budget.

There are a bunch of different sections, more than I can grab in one screenshot, and you can easily move them around to organize your budget the way you want. You can also re-order the line items within each section.

Adding Transactions

You have been setting your planned spending amounts up until now. You don’t track actual earnings and spending until you add transactions.

You can add an income or expense transaction, the screen above shows an expense at Chipotle for $24. You can split the transaction across many categories. Here I’ve categorized it under Restaurants, but you can see where you can add another category with “Add a Split.”

If you click on more options, you can add a Check # as well as Notes.

If you switch the transaction type to income, the options don’t change. The only difference is the button changes to “Track Income” instead of “Track Expense.”

On the dashboard, you can see what you’ve budgeted and what you have left to spend:

EveryDollar Premium+

You can budget for free with EveryDollar, but if you want to be able to connect your bank accounts, you’ll need to upgrade to Premium. You’ll get 14 days free, and then it costs $17.99 per month, or $79.99 per year.

Along with importing your transactions, Premium+ allows you to set goals, access paycheck planning, and get a financial roadmap. You’ll also have access to a financial coach.

You can also upgrade to Ramsey Plus, which gets you a few more items, such as Financial Peace University. Ramsey Plus costs $129.99 per year after the 14-day free trial.

Paycheck Planning

Paycheck Planning is available on Premium+ and allows you to schedule the dates of your income and bills. You can set your paydays and then what days you wish to pay specific bills. Once that is set, you can set dates to fund other goals, such as your sinking funds.

With this feature, you can also turn on SafeSpend, which lets you know how much your paycheck is earmarked for specific categories, and how much you have to spend.

Financial Roadmap

With the Financial Roadmap feature, you can see your whole financial picture at a glance. You can see where you stand with your net worth, as well as get future predictions based on your current situation. If you follow Dave Ramsey’s baby steps, you can see your progress and projected dates for when you will complete each step.

You can customize the plan and play around with variables to see how small changes today will impact the future.

EveryDollar Alternatives

EveryDollar offers zero-based budgeting but not much more, so if you want a different budgeting strategy, EveryDollar isn’t the best choice.

Also, EveryDollar doesn’t track investments or have a community to join. For any of those, you’ll need an alternative. Check out these suggestions below or our list of the best budgeting apps for couples.

You Need a Budget

The closest alternative to EveryDollar is You Need a Budget, or YNAB. YNAB is a zero-based budget “give every dollar a job” system that costs $14.99 per month, or $109 per year, and comes with a 34-day trial.

In a YNAB vs. EveryDollar comparison, YNAB has a slightly bigger learning curve, but the tool and support are way better. One of YNAB’s biggest assets is the community of people who use it. You can get a ton of support from the company and other people like you.

Here’s our full YNAB review for more information.

Simplifi

Simplifi is a budgeting app that is very easy to use. You can plan and track your spending, set goals, and manage your subscriptions. Your transactions will also download automatically for easy categorization. You can run reports and get cash flow predictions, so you’ll always know where your money went, and where it’s going next.

Simplifi costs $2.99 per month for the first year and $5.99 per month after that.

Here’s our full review of Simplifi to learn more.

Empower

Empower has automatic transaction downloads to a budgeting tool that does basic expense tracking and budgeting. Empower is not on par with similar budgeting tools but they do investment tracking, which isn’t available in EveryDollar and others on this list.

As your finances evolve beyond budgeting, you’ll want an eye towards the future and your retirement. Empower offers those tools for free and is a good way to help ensure your investments perform the way you need them to.

Here’s our full review of Empower for more information.

The Bottom Line on EveryDollar

If you’re a fan of Dave Ramsey and his approach to money management, EveryDollar is an intuitive and easy-to-use tool to help you manage your money. The interface is also very clean and doesn’t appear to have advertisements.

If you’re just looking for a budgeting tool, it’s hard to justify paying $130 a year for a budgeting tool like this one. When you lay in the educational component, it makes a little more sense but I’d argue your money is better off spent on necessities rather than a budget. There are many great budgeting tools available for free (or ad-supported) so you can keep the $130 to go towards something else.

If you’re interested in the Ramsey Pros or the financial education, it might be worth it. That’s really up to you to decide.

Other Posts You May Enjoy:

6 Best Budgeting Software Tools

Budgeting no longer means spreadsheets. There are tons of tools out there that can help you make a spending plan…

Greenlight Alternatives – Find the Best Debit Card for Your Kids

Greenlight is a banking app designed to not only enable your kids to spend money using a debit card –…

Chime Credit Builder Review: A Free Secured Card Option

Chime Credit Builder Visa Card $0 Product Name: Chime Credit Builder Visa Card Product Description: Chime Credit Builder Visa is…

How to Break the Paycheck to Paycheck Cycle

When you are living paycheck to paycheck, breaking out of that cycle seems impossible. You’re always playing catch up or…

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.